Written by Dyanne Harvey for Founder Shield

Founders often pursue their passion, from renting a new office space (and the perfect jade plant as a desktop cheerleader) to researching market fit through mounds of analytics. It’s exciting!

Better yet, starting a business is a hefty serving of delight with a dash (or three) of anxiety. And here’s the thing, there’s more behind-the-scenes-action involved in planning a business than most owners expect — but we’ve been in those trenches. For those interested in longevity and value over rapid scaling, we need to talk about business insurance for startups. Why? The answer may surprise you.

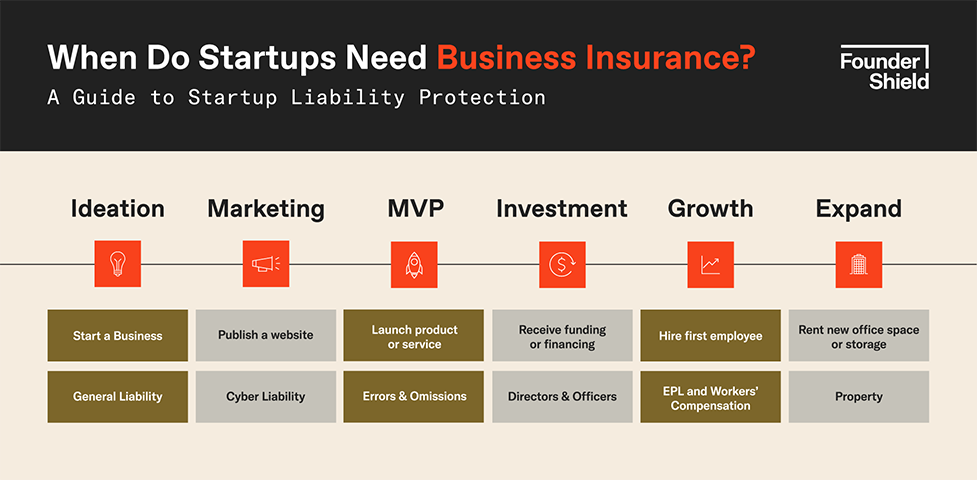

Milestones That Prompt Business Owners to Get Insurance

Many entrepreneurs think that insurance is little more than a tick on a to-do list, the least attractive part of the endeavor. As partners to many startups backed by financing or funding, we can attest to the unappealing status of insurance coverage. Designing logos is far more fun — plain and simple.

However, as a founder, you must consider more than merely what consumers see. Really, it’s what happens behind the curtains that keep the gears grinding. What do we mean?

For one, consider the contracts connected to your startup: vendors, clients, landlords, etc. Each legal agreement has ramifications if obligations aren’t met. Business insurance for startups responds to many situations surrounding issues with contracts, from hiring your first employee to leasing a physical space. And that’s just for starters.

Example: Rebecca’s Software Startup Fire Damage

Consider the following example: Rebecca’s software startup was thriving in its rented office space downtown. One day, a faulty wiring issue resulted in a fire, causing substantial damage to the office. The lease agreement held Rebecca responsible for any damage to the premises. Faced with a costly repair bill, she turned to her commercial property insurance. Her policy covered the cost of the repairs, helping her swiftly restore the office space without significant financial stress. The insurance saved her startup from unexpected expenses and protected her relationship with the landlord, ensuring her company could continue to operate from its prime location.

The Role of Risk Management in Business Strategy

Fortunately, the clever founder in the above example prioritized risk management. Had she not, many of the hard-earned achievements — positive landlord relationship, client rapport, increasing revenue, chic office space, etc. — would have been lost.

Here’s the skinny, risk management is proactively protecting the ground you’ve already covered. It’s thinking several steps ahead and purposefully considering the what-ifs. However, this approach works best woven into the fabric of your business strategy, influencing decision-making and long-term business planning. But protecting a startup, regardless of the industry or niche, can feel overwhelming.

Here are five steps to simplify the process:

- Identify: Pin down specific vulnerabilities your business might face. Here’s a tip: start big and go small by dialing in on the most apparent risks first to get the ball rolling.

- Analyze: Recognize how bad it would hurt your business if the risk occurred (yes, the notorious “what ifs”). Consider the financial loss, dip in workforce morale, reputational damage, etc.

- Evaluate: Decide if you can accept the risk or need to transfer, avoid, or reduce it.

- Track: Map out specific exposures, including how the damage occurred and how your business recovered from the loss. This history, even short-lived, is invaluable knowledge.

- Treat: Develop a framework around the exposure to better support your business’s goals.

Business insurance for startups is only one piece of the risk management pie. Still, it’s one of the most reliable treatments for navigating such challenging terrain. Business insurance plays a vital part in mitigating risks and ensuring business continuity.

Insurance Tips for Founders Managing a New Business

Startup founders make numerous important decisions during the infancy of their business, including how not to go belly up. Fortunately, insurance is a best practice that has proven successful time and time again; it’s the ultimate safety net.

As mentioned, business insurance for startups isn’t merely a tick on a to-do list. It’s more like a comforting short story you read for the second time on a Sunday afternoon because your soul needs it. The one where the good guy wins, and the dog lives. But how does business insurance go from dull to-do list status to an engaging short story? Simple — we customize.

Startups only need a handful of existing business insurance policies; they need a short story. A novel would be more like what a late-stage company needs before ringing the opening day bell on Wall Street. In comparison, a to-do list tick seems like inserting coins into an insurance machine and expecting adequate policies to come out. Neither will do.

Aim for the short story sweet spot, which often includes the following building blocks of business insurance:

- General Liability: Protects startups from the fundamental risks of doing business, earning it the nickname “all-risk” coverage.

- Cyber Liability: Cyber insurance safeguards startups against losses from electronic activities, like cyberattacks or data breaches. (The average data breach cost from remote working is $137,000).

- Employment Practices Liability: Protects startups against employment-related allegations of violated rights, such as discrimination or wage disputes.

- Errors & Omissions: Also known as professional liability, this policy protects startups against lawsuits claiming inadequate work and third-party claims, such as copyright infringement or slander.

- Directors & Officers: This policy provides three tiers of coverage — Side A, B, and C — protecting executives against claims of mismanagement. (Pro tip: beef up your Side A tier.)

It’s worth mentioning that workers’ compensation insurance is required throughout the United States except in Texas. Also, many of the above policies often fulfill contractual requirements, such as business licensing approval or vendor agreements.

Aside from the must-haves, business insurance helps to legitimize startups, empowering founders to launch new products, hire more employees, and raise funds to grow or scale. In fact, consider these milestones as checkpoints for owners to re-examine their insurance programs and add more customization to their risk management strategy.

Download the Business Owner Risk Management Checklist

Startups transform quickly, so founders must regularly review and update insurance policies. However, a commercial insurance broker should work as a partner, nurturing an ongoing conversation about upcoming events, like product launches or office space expansion.

Lastly, do your due diligence with the insurance carrier, researching reputation and history. Some carriers provide different coverage than others and at varying costs. It pays to ask questions and do your research — no one is better to ask than your trusted broker.

Key Benefits of Having Proper Business Insurance

Despite the unrivaled confidence in your startup’s products or services, some things are out of our control. Consider changing weather patterns and Mother Nature’s impact on your property or outages in your area. Similarly, an ebb and flow in our culture may shine a positive or negative light on your business at any given time. And we haven’t even touched on the digital landscape — the murkiest of waters.

The point is that business insurance for startups wears many hats, much like founders. More importantly, it provides key benefits to new companies. This vital coverage offers financial protection and peace of mind. However, business insurance also improves credibility. As mentioned earlier, it contributes to the legitimacy of your startup and, thus, enhances attractiveness to investors and lenders.

Finally, adequate insurance coverage contributes to the longevity and value of the business. It makes a space for sustainable growth. Simply put, risk management empowers founders to create a more meaningful impact.

Common Misconceptions About Business Insurance

Regardless of business insurance’s numerous benefits to startups, it often gets a bad rap. You’ve likely heard comments like, “It’s too expensive” or “My business is too small to need insurance.” Common sense responses to those remarks mean a premium is cheaper than a lawsuit or loss. And unfortunately, legal fees nor financial losses pay much attention to a business’s size.

Founder Shield’s General Manager, Jonathan Selby, often says, “It’s not if a cyberattack occurs, it’s when.” In his defense, the data is on his side. Startups typically have more limited resources and expertise to pour into cybersecurity, so hackers often target them specifically. Fundera reports that 43% of cyberattacks target small businesses, and 60% of those companies are out of business within six months of the attack.

The truth is that a cyberattack, lawsuit, or loss doesn’t have to devastate your business. Conversely, a business insurance premium doesn’t have to cost you an arm and a leg. Consider the MAXPRO case study, which reports a 40% reduction in annual spending for the D2C exercise equipment manufacturer after condensing four separate policies into one program.

Customization is key. We encourage founders to consider business insurance a critical part of their startup’s planning process. Give insurance the space in your strategy to promote value and longevity in your business. Learn more about your options by contacting a seasoned insurance broker specializing in what startups genuinely need to thrive and stay protected. To get started, schedule a risk assessment today!